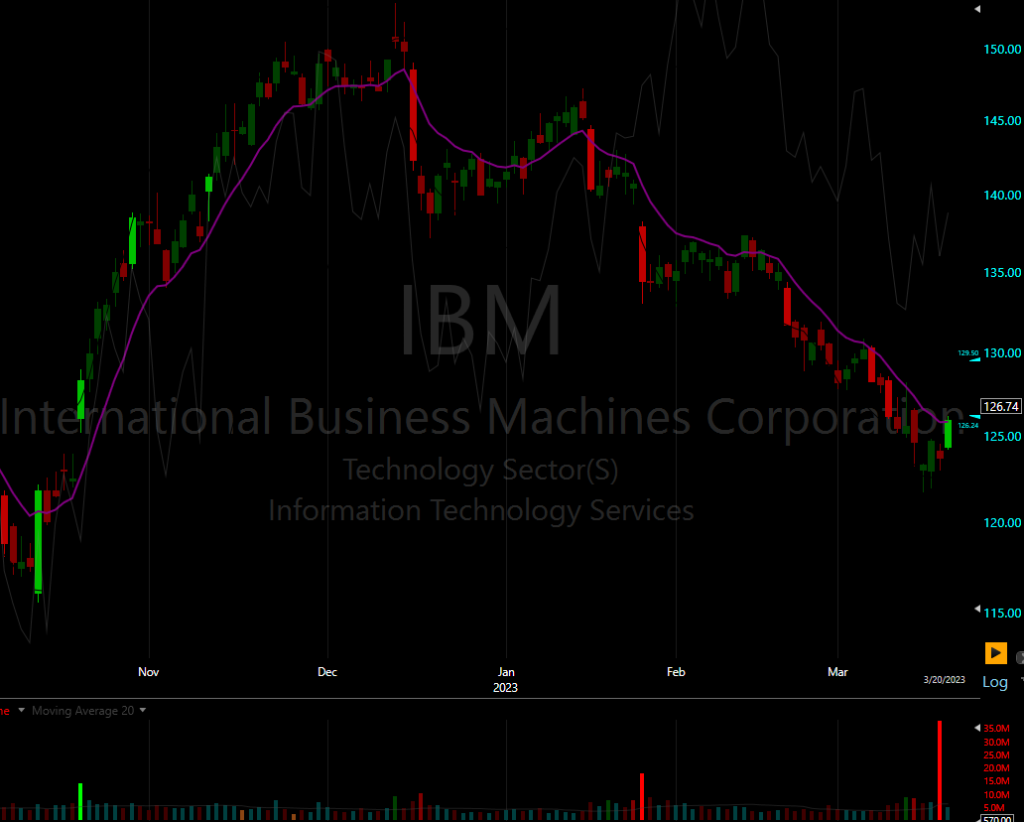

IBM provided at least one good risk-reward opportunity today, offering a potential gain of 0.62% in just 14 minutes.

The opportunity involved buying when a large candle crossed the VWAP(orange line). Buying at the indicated point could have resulted in a potential 0.62% intraday gain in just 14 minutes. While 0.62% may not seem like a lot, the advantage of trading IBM is its low volatility, which allows for a very tight stop loss (0.10% near the big candle low was ideal) and the ability to risk more money.

How was it possible to be alert if IBM would have an easy-to-trade movement today?

Although there were no apparent catalysts, IBM printed a big negative volume yesterday and a sort of reversal candle three dat ago, which were enough reasons to keep an eye on the stock for today and the following days. The stock is showing signs of a possible bottom. For today, an alert when the stock surpassed yesterday’s HVC (high volume close) was ideal.